What do the best DACs, the best Hi-Res Audio players, the best TVs, and the best soundbars all have in common? They’re all facing component shortages and price hikes – not because of tariffs, but because of the AI-driven shortage of memory and storage chips. And the pain’s going to be particularly pronounced at the more affordable end of the market, where profit margins are already razor-thin.

As you’re no doubt aware, the AI industry is buying a lot of memory for its data centers: as Reuters reported back in October, just one AI firm, OpenAI, intends to order 900,000 semiconductor wafers in 2029. That’s around 40% of the world’s entire production. And there’s plenty more demand in the industry.

As The Wall Street Journal reported this week, “The rapid build-out of infrastructure for artificial intelligence is consuming a large portion of available supply of NAND flash memory, DRAM memory and hard drives. That has resulted in a shortage of memory for other markets such as PCs and smartphones.”

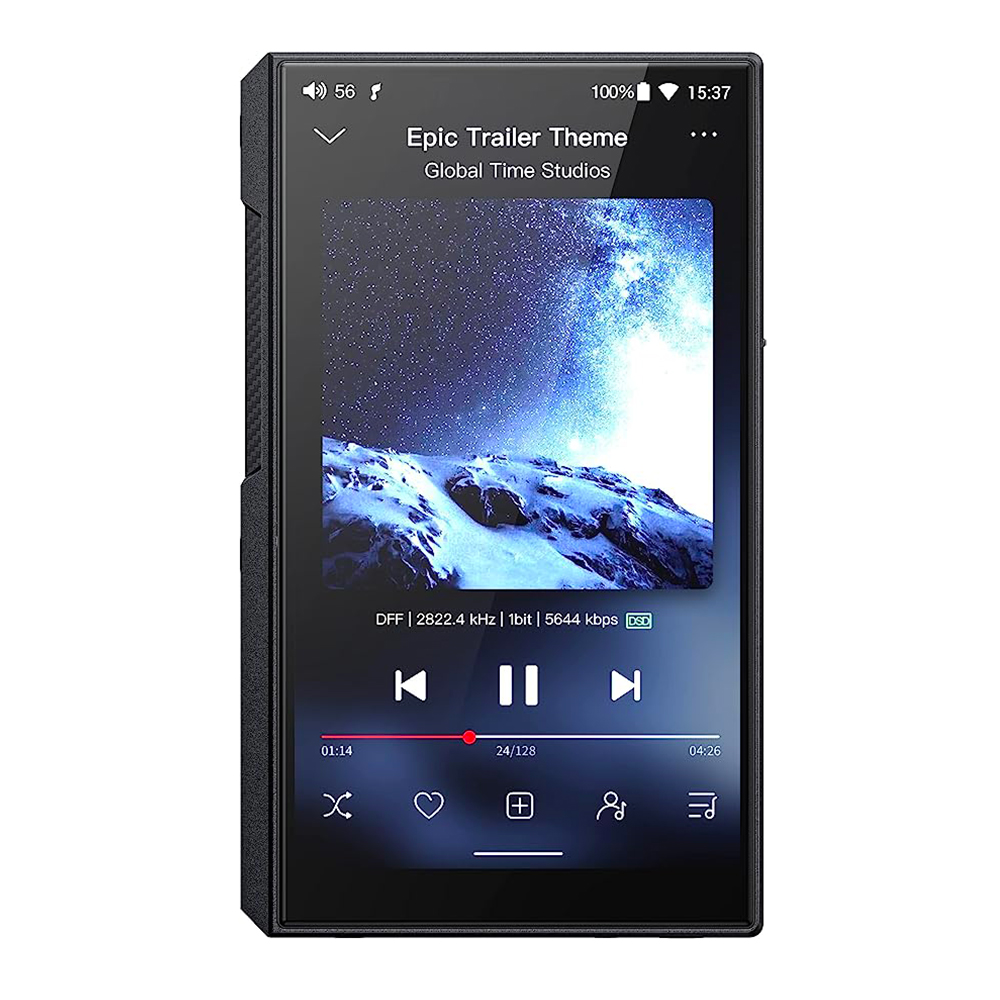

Audiovisual devices aren’t the same as PCs, and don’t typically need as much memory as smartphones. But they still need some memory in order to do what they do. Everything from smart speakers to smart TVs to in-car entertainment systems use RAM alongside their processors, and some of them use NAND storage too, because they’re all just small computers at heart; both of these components’ prices are rocketing.

We’ve already seen Samsung warn that its TVs’ prices may rise due to comopnents shortages, while there are warnings about smartphone makers scaling back their specs for this year’s mobile phones, cutting their memory to cut the cost of manufacturing.

And according to NPR, memory prices are expected to rise even more this year. As Avril Wu of the consultancy Trendforce told NPR, “I keep telling everybody that if you want a device, you buy it now.”

How AI could affect AV

AI data centers don’t use the same memory chips as a DAC or a Hi-Res Audio player: they use High Bandwidth Memory (HBM), not the DDR RAM you’d find in a PC or PlayStation. But those differing chips are made from the same kind of semiconductor wafers, and those wafers are in ever-increasing demand because HBM uses roughly three times more of those wafers than DDR5 RAM does.

They’re also much more profitable to sell, and as a result many firms are shifting focus from consumer memory chips to data center ones – so for example Micron, one of the big three memory makers alongside SK Hynix and Samsung Electronics, has shut down its long-standing consumer memory business, Crucial, “to improve supply and support for our larger, strategic customers in faster-growing segments”. In other words, AI.

As some manufacturers shift focus, new capacity for other kinds of memory isn’t coming on board fast enough to cover the demand. So for example in October SK Hynix announced that it “has already secured full customer demand for its entire DRAM and NAND production for next year”, and that it’ll need to expand its production to cope with the market demands – but even the equipment to make the chips are set to rise in price.

In the shorter term, that means higher memory prices. Much higher prices. CNBC reports that RAM prices are expected to rise “more than 50% this quarter compared to the last quarter of 2025.” And the Bloomsbury Intelligence and Security Institute says that “DRAM prices have also surged 171% year-over-year, outpacing gold, while DDR5 spot prices have quadrupled since September 2025. DRAM and NAND prices doubled in a single month”.

While capacity is being added to existing production plants and new plants are being built, that capacity isn’t expected to come online until 2027.

That’s likely to have two key impacts on the AV hardware market. The first is that we’ll see price increases down the line, especially at the budget end of the market where manufacturers can’t simply swallow the increased cost: there’s a lot less margin on a $300 smart TV than a $3,000 one.

The second is that manufacturers may go back to the drawing board as some smartphone firms have done, limiting their next products’ specifications to compensate for shortages and price hikes. It may also persuade some firms to postpone their product plans altogether until market conditions are more favorable.

We’ve been here before, of course: I remember the completely fruitless search for in-stock AV receivers after chip production had shut down during COVID lockdowns. At least this time we know the component crunch is coming, and can make purchasing plans accordingly.

Our picks of the best AV gear across different categories

The best TVs for all budgets

The best soundbars for all budgets

The best 4K Blu-ray players for all budgets

The best projectors for all budgets

The best wireless earbuds for all budgets

The best noise cancelling headphones for all budgets

The best Bluetooth speakers for all budgets

The best music players for all budgets

The best headphone DACs for all budgets

Follow TechRadar on Google News and add us as a preferred source to get our expert news, reviews, and opinion in your feeds. Make sure to click the Follow button!

And of course you can also follow TechRadar on TikTok for news, reviews, unboxings in video form, and get regular updates from us on WhatsApp too.